8 Best PAYMENT GATEWAY in 2019: Boost Your Profit by 85%

Running an online business is not a big deal in 2019! The main problem is to find the right payment gateway.

Let me explain!

If you are running an online business, then you need a way to accept payments. After all, you are not running a charity business. Off course, you are trying to get your product in the hands of as many peoples as possible.

But, picking an appropriate payment gateway can be a tough task!

There are lots of things to consider, various options out there!

Let me tell you the Best Payment Gateway

- Does it matter which one you select?

Yeah! it does.

- A right choice can increase the visibility of your product or brand by 85%.

This is the reason, why the selection of the payment gateway is a most important part of your job!

How Payment Gateways Helps your Business to Produce 100% Profit?

- 40% of users are searching for a way to pay online through offline.

- 20% of customers found easy options to connect to their credit card processor of choice.

- 40% of shoppers from around the world to have access to your store and can expand your customer base exponentially.

Payment gateway solutions perform some essential tasks in online buying & the management of transaction. Rather than forwarding payments, the payment gateway solutions allow the funds being transferred to a seller and do so in a safe and comfortable manner for a buyer.

Depending on your location, payment processing firms also should adhere to PCI compliance standards and add as various security methods as required to prevent fraud. Most of the payment gateway technologies are too open to alteration and invite developers to create custom payment pages and insert those on their site.

I will divide the payment gateway in 3 major section –

- One to one (simple payments)

- One to many (parallel payments),

- Pay the main receiver to multiple secondary receivers of payment (chained payments).

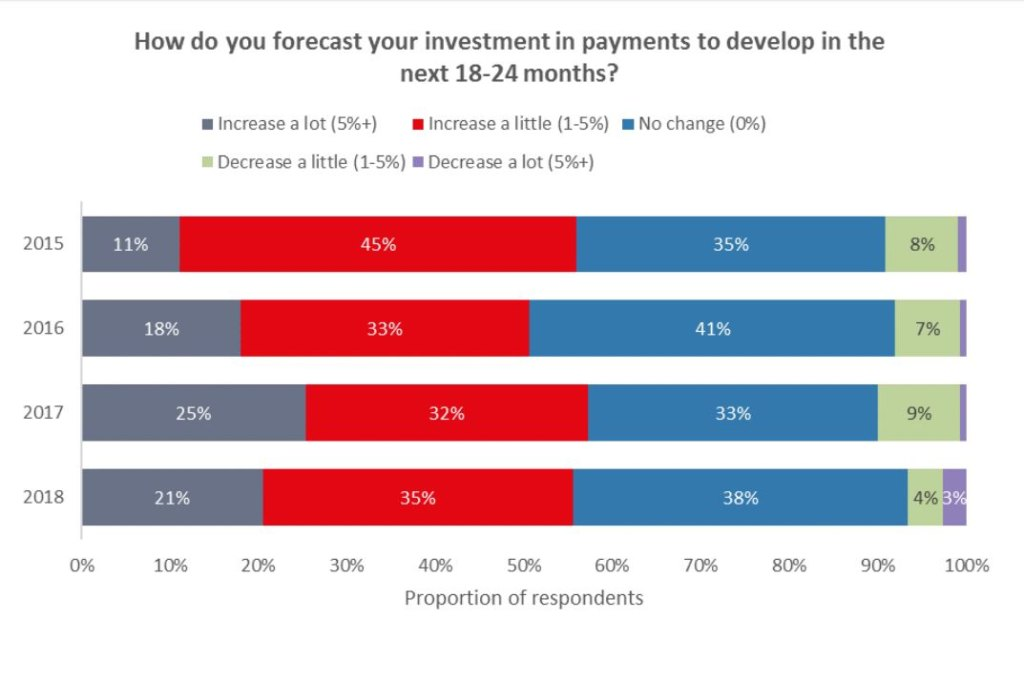

As per the study of 2018, the businesses are supposed to considerably expand their investments into the payment capabilities due to strengthening competition and mounting customer expectations.

Businesses are involved in a massive digital transformation action to improve operational performance and present an exceptional user experience.

A related study stated that more than 56% of organizations have expanded their online payment system spending on a global scale.

A key preference amid online marketers is improving the integration between their center business operations with the payment gateway they use. Another core is producing enhancements to their online payment approval functions.

Overall, online payment gateways are supposed to clarify and expedite transactions and assist businesses to earn the trust their customers by streamlining their checkout journey.

Now, let me tell you –

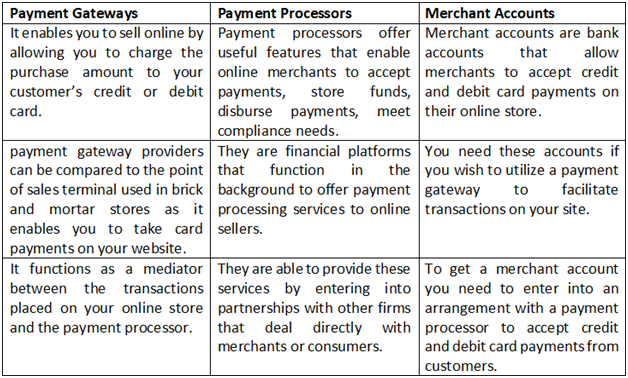

What are the Difference Between all the three;

- Payment Gateways

- Payment Processors

- Merchant Accounts

If you’re new in order to online payments. You’ve might be heard people discussing payment gateways and payment processors or merchant accounts. It can be confusing, so let me explain you.

I hope the above information will give you an introduction about payment gateway and the difference between the payment gateway, payment processor and merchant account!

Now, let me tell you the –

Best Payment Gateways in Trending 2019!

Increase the Visibility of Your Brand in the Entire World

With so numerous strong and successful payment gateways! But, have you chosen the right one?

The choice of whom to entrust the payment information is perpetually a tough one!

This is the reason why we invite you to examine our comparison of the 8 best and reliable payment gateway providers for 2019. Also, I will tell you the services and offer they provide you!

Please make sure you do compare their charges and fees! And, also take a gander on their extra features they offer.

So let me start from the scratch –

Top 8 Payment gateways in 2019

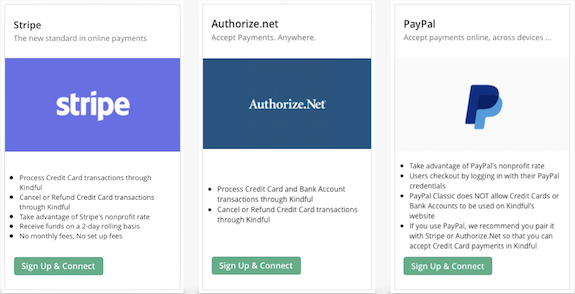

- Authorize.Net

- PayPal Payments Pro

- Square

- Stripe

- Amazon Payment

- Skrill

- 2Checkout

- SagePay

Let me start from the first which is –

Authorize.Net

- Year Founded – 1996

- Platform – Web | Android | iOS

- Countries Served – Asia, India, Australia, Canada, China, Europe, Latin America, Middle-East and Africa, United Kingdom, United States.

- Industries – Computer Software, IT Services, Internet, Marketing & Advertising, Retail, Financial Services, Hospital & Health Care, Nonprofit Organization Management, Higher Education and Management Consulting.

- Used by – WeKanCode, sibzsolutions, Growth Technosoft, Candid Technologies, SYSCRAFT INFORMATION SYSTEM PVT. LTD.

Authorize.Net is most known and oldest payment gateway for eCommerce. Set up in 1996, and it is headquartered in American Fork, Utah.

In 2007, Authorize.Net was taken by CyberSource, and the CyberSource was also acquired by Visa in the year of 2010. The company has offered payment gateway services to more than 400,000 merchants and dealers since origin.

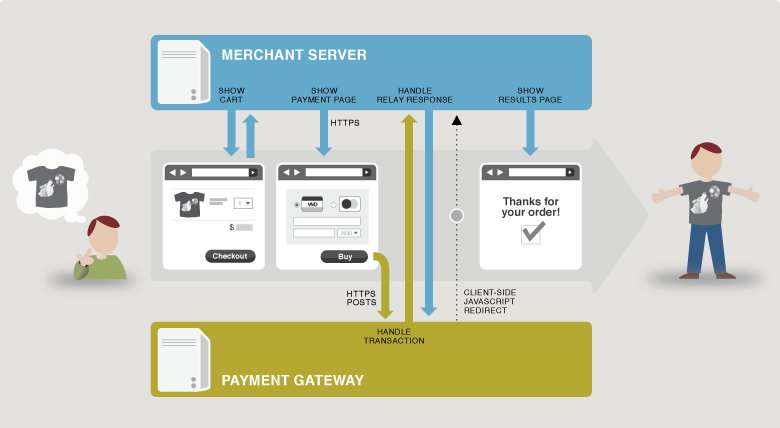

Authorize.Net is a payment gateway system that provides the required foundation and security quick and dependable data transmission. You don’t have to install any types of software as this solution oversees online transaction directing simply like an ordinary/conventional card swipe machine.

Being a pioneer in this industry! Authorize.Net have earned the trust of little and medium organizations. By giving them a moderate and safe payment system.

You will likewise acknowledge about this platform is providing 24*7 free support! That given by educated experts!

They will likewise help you when developing custom connections. On their site, you will likewise discover a variety of training materials and tutorials! With the goal that you can enhance the capability of the platform.

Let me show you how it works –

Why Authorize.Net is Best One?

Vigorous online payment system: Authorize’s online payment system acknowledges Mastercards and electronic checks from sites! Furthermore, store assets into your trader ledger! It is sparing time and money for little to medium-sized organizations.

VPOS: In a retail setting, you can utilize Authorize.Net as a customized virtual purpose of offer system (VPOS). In case you as of now have a decent POS set up, this platform will be anything but difficult to coordinate with it.

A virtual terminal for manual transactions: Authorize.Net likewise has a virtual terminal! Furthermore, it permits clients who take mail and telephone orders from their clients. It will present the transactions through manual.

MOBILE transactions additionally acknowledged by means of its free mobile application or an outsider arrangement! that would acknowledge credit card payments over a cell phone.

Check payments: Authorize.Net offers a selective, incorporated electronic check payment strategy! It acknowledges and forms payments from financial balances through the client’s site! Or then again the Authorize.Net Virtual Terminal.

Client integration manager (CIM): This platform empowers clients to tokenize and store their clients’ delicate payment data! Ideal on Authorize.Net’s protected servers improving the PCI DSS consistency! Furthermore, the payments procedure for returning clients and repeating transactions.

The cons identified with Authorize.net is that the mobile application of this payment service needs in the supply of products and ventures. Moreover, you need the entrance to this portal, you need a trader account made for it. Authorized.net is essential payment door and it isn’t giving chain payment system.

Presently an inquiry may strike a chord!

The amount Does Authorize.Net Cost?

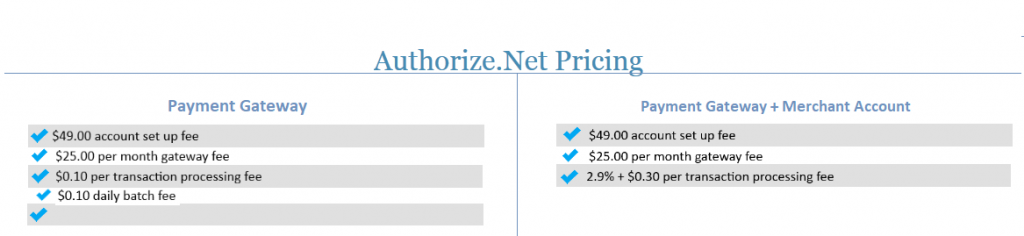

Authorize.Net offers two distinctive payment handling administration designs:

- A mix of Payment Gateway and Merchant Account

- Payment Gateway Only

Here are the recorded costs for the two alternatives:

To what Time Does It Take for The Assets to Be Kept Into My Ledger?

The Merchant Service Provider (MSP) encourages transferring assets to your financial balance. Financing time can differ contingent upon your MSP. The business normal financing period is between 3-5 business days.

What Time Payment Gateway Process Take, and what is required?

Upon appropriate fulfillment of the application, your Authorize.Net Payment Gateway account is endorsed naturally. In any case, so as to acknowledge Mastercards, you should have a merchant record, and endorsement for that record can be prompt or take from 1-5 business days or additionally relying upon a few elements, including industry, financial record, and responsiveness.

In the event that you have a current merchant account, you can refresh your passage with the parameters given by your merchant supplier and be prepared to execute inside minutes.

QuickTip: 1

I accept most organizations run with Authorize.Net in light of the fact that they need a strong help group, great security and an interface that isn’t too difficult to even think about integrating with different platforms. Along these lines, you pay some additional money for that significant serenity. In this way, I like to prescribe Authorize.Net to little, medium and expansive organizations that need the full bundle.

A few organizations aren’t prepared for Authorize.Net on the grounds that they might not have the income. In any case, when that money begins coming in, authorize.Net is a strong decision.

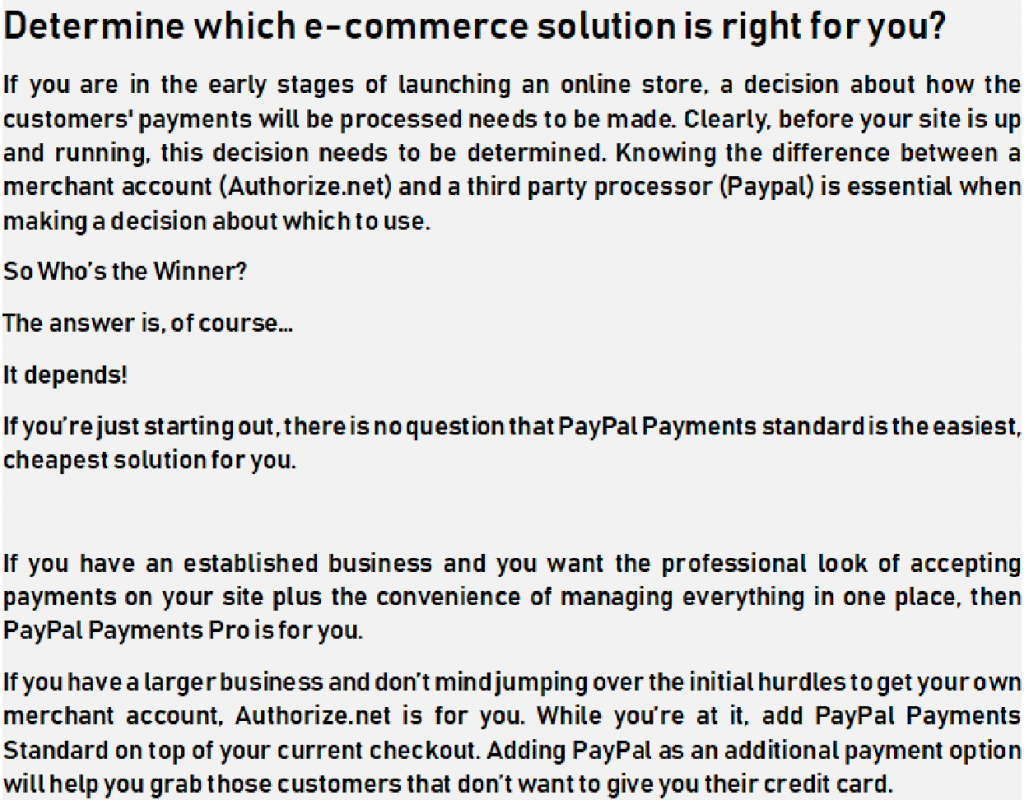

In the Authorize.net versus PayPal debate, the two platforms offer the chance to acknowledge credit card payments in an auspicious manner. The procedure and expenses are what must be considered.

A minimal effort arrangement is PayPal Standard; however, this procedure takes a customer off your site to process the transaction. The expenses of PayPal Pro and Authorize.net are basically the equivalent.

As ChromeInfotech a leading iPhone and Android application development company, we have also tested Authorized.net service for our clients, and we can say it is one of the best payment gateway and merchant service provider for your business.

The Next Payment Gateway is –

Paypal Payments Pro

- Year Founded – 1998

- Platform – Web | Android | iOS

- Nations Served – Asia, India, Australia, Canada, China, Europe, Germany, Japan, Latin America, Middle-East and Africa, United Kingdom, United States.

- Ventures – Nonprofit Organization Management, Civic, and Social Organization, Religious Institutions, Retail, Hospital and Health Care, Education Management, Computer Software, Health, Wellness and Fitness, Entertainment, Information Technology, and Services.

- Utilized by – Highway 61 Blues Museum Gifts, Lifetime Creations, Haugan Cruises!

Payments Pro is PayPal’s at last fruitful endeavor! To present a payment handling service for eCommerce clients. Who doesn’t really have a PayPal account?

In this way, Payments Pro is unquestionably a sensible decision! When choosing whom to endow your money transactions.

The end-to-end platform supports credit cards!

-

Visa, Master, DISCOVER, American Express, PayPal, PayPal credit

What’s more, depends on an open API system. That can relate effectively to any shopping basket/commercial center solution. It likewise permits telephone based credit card payments! What’s more, gives clients a helpful invoicing unit to charge customers immediately.

In the meantime, it is sufficiently adaptable to be utilized by independent companies and market pioneers, in a reaction of which it can applaud with more than 184 million client accounts (up until this point!).

Not surprisingly, Payments Pro is likewise a good example of secure checkout! Be it that you’re transmitting money from your neighborhood or cell phone.

It offers an assortment of alternatives for clients to streamline PCI consistency! Also, holds fast to all driving encryption norms to keep payment qualifications watched.

It is additionally the most global payment portal right now! As it acknowledges 26 driving monetary standards, and it is accessible to use on more than 200 markets.

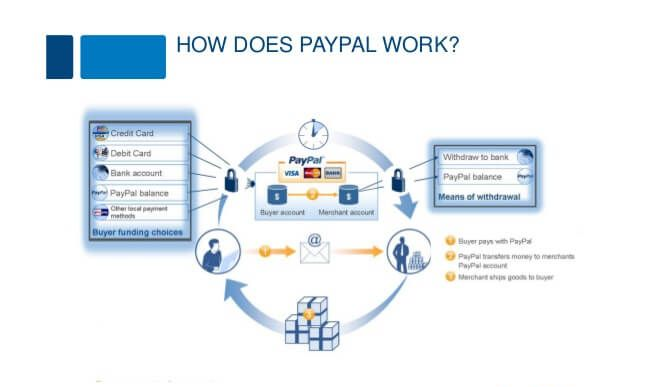

Considering how PayPal Works? Here we go –

Presently an inquiry may strike a chord!

Why PayPal Payments Pro Is Best for Your Business?

A PayPal solution that doesn’t expect payers to have a PayPal account: PayPal Payments Pro was created to help eCommerce clients! Furthermore, enable them to acknowledge Visa and check card payments. And furthermore remunerates from clients without a PayPal account.

Custom checkout: As an undertaking grade platform! PayPal Payments Pro gives the client a chance to redo checkout as he needs it! What’s more, can make a positive checkout encounter for his clients. This implies you can coordinate all the design and hues that coordinate your organization’s subject and brand.

Quick Mobile payments: With PayPal Payments Pro! Getting money isn’t restricted to office work areas and PCs. You can without much of a stretch transform your cell phones into moneymaking machines! Without experiencing complex logging methods, and sending repetitive solicitations.

Access to your money inside minutes: Once payment is sent and procedures! PayPal Payments Pro takes truly minutes to make it accessible to you. Obviously, you are offered the alternative to keep money on your PayPal record or transaction them to your credit card.

Really coordinated payment door: PayPal Payments Pro works flawlessly with all driving eCommerce solutions! CRM and deals the executive’s instruments, and best bookkeeping systems. In the meantime, it associates with all significant shopping baskets in the market immediately.

- Note – Paypal is giving mobile payment system that can work in all sort of basic, parallel and chained payment system. If you are running an application which is developed on react native platform, then PayPal is the best choice for you.

After this, I will let you know –

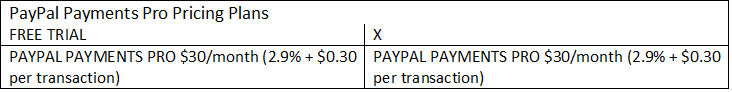

The amount Does PayPal Payments Pro Cost?

PayPal Payments Pro offers a basic valuing plan! For their service that incorporates APIs, simple truck integration, web-based invoicing, and telephone-based credit card payments. Here’s the expense of utilizing this service:

- PayPal Payments Pro – $30/month.

- Flat rate for each transaction – 2.9% + $0.30.

- Accept PayPal payments. (counting 26 monetary forms from in excess of 200 markets).

- Accept PayPal credit payments (for the US as it were).

- Accept charge and Mastercards. (counting multicurrency payment handling for 6 monetary forms).

- Accept telephone payments through Virtual Terminal.

- Optimized mobile checkout encounter.

- Keeps purchaser on your site all through checkout.

- Simplifying PCI consistence choice.

Financing time can change contingent upon your MSP. The business normal financing period is between 3-7 business days.

Presently an inquiry may ring a bell!

Quick Tip: 2

In case you are running an eCommerce site and needing a payment solution! That acknowledges credit card payments and needn’t bother with your purchasers to have a PayPal account!

At the point, PayPal Payments Pro merits considering. This payment preparing solution enables you to acknowledge payments! Through credit cards, platinum cards, rewards, and furthermore PayPal credit. It will give you adaptability and security that accompanies PayPal innovation.

Whatever your business necessities are! PayPal Payments Pro offers you unmatched adaptability. By enabling you to arrange the service the manner in which your business requests. As a genuine endeavor class payment handling platform, you can change it any way you need to.

With an altered checkout! You are responsible for giving one of a kind, positive checkout encounter for your customers. You can coordinate format and hues to coordinate your organization’s subject and brand.

What’s more, PayPal Payments Pro works consistently. With all the significant shopping baskets in the market immediately.

After this, let me reveal to you the following one –

Stripe

- Year Founded – 2010

- Platform – Web | Android | iOS

- Nations Served – Australia, Canada, United Kingdom, United States, France, Spain, Ireland, Germany, Italy, and Denmark.

- Enterprises – Nonprofit Organization Management, Civic, and Social Organization, Religious Institutions, Retail, Hospital and Health Care, Education Management, Computer Software, Health, Wellness and Fitness, Entertainment, Information Technology, and Services.

- Utilized by – Ibel Agency, Four Sisters Old Time Photo, Kansas City Zoo, Dawn Of The Donut!

Topping our rundown is Stripe! An online payment platform that was made by industry specialists. Who has set up an association with the more extensive payments industry!

From anticipated accomplices—nearby banks, real card systems.

The PCI Council—to the unforeseen—the W3C! Web program suppliers, and industry affiliations.

It is exceptionally engineer driven! Enabling you to quickly assemble generation prepared incorporations with present-day apparatuses. From React segments to constant webhooks.

Utilizing Stripe’s developer platform implies less upkeep for heritage systems. Furthermore, more spotlight on center client and item encounters.

Moreover, it forms charges and shows costs in a client’s favored money. To enhance deals and help clients stay away from change costs. Agreeing to accept the payment portal is sans inconvenience and quick.

Presently an inquiry may ring a bell!

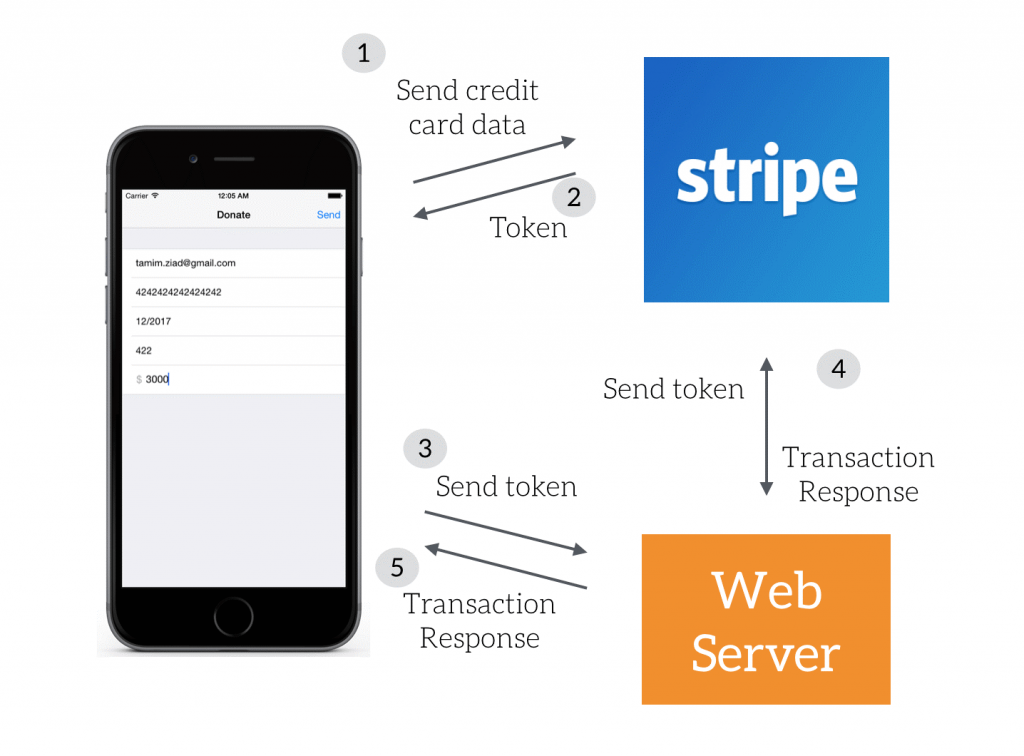

How Does Stripe function?

The application first gathers payment data including email, credit card number, termination date, CVC, and payment sum from the payment frame. It at that point sends the credit card information to Stripe backend by calling its API.

In the event that the payment data is legitimate, Stripe will return you a token. Now, the Mastercard isn’t charged yet. Afterward, you’ll utilize the token to play out the genuine transaction.

Presently that your application gets the token. The subsequent platform is to send it to your own server to finish the charging procedure. For security reasons, Stripe expects you to play out the real charging procedure through a server rather than the cell phone itself. No stresses. Stripe has given us the server code to actualize the charging procedure effortlessly. We’ll discuss that in a later area.

Your web application sends the token to Stripe to play out the real charging. Regardless of the transaction succeeds or not, Stripe will return you the outcome.

In conclusion, the server side sends a reaction back to the application about the transaction result.

Brace yourself for what I’m about to tell you –

Why Stripe is Best for Your Business?

Modified checkout experience: The UI toolbox gives you components from Stripe’s very own aggregate involvement. For front-end, structure, and investigation that you can use to fabricate and modify your very own payment frames.

You can without much of a stretch implant checkout on your site utilizing just a solitary line of JavaScript.

Various payment choices: You can bolster the payment door favored by your client. As Stripe offers an assortment of choices. Go worldwide by preparing payments for all real credit and credit cards in each nation.

Advanced wallets, for example, Alipay, Amex Express Checkout, and Apple Pay are accessible. For clients who need an advantageous way. To pay without sharing their card data.

Secure payment handling: When it comes to income enhancement! Stripe enhances steering ways through direct incorporations with card systems.

Like Visa, MasterCard, and American Express. This pre-preparing layer diminishes transaction dormancy and enhances achievement rates. It likewise includes an extra layer of validation.

To stay away from extortion dangers and chargebacks. The debate taking care of is mechanized to effectively submit proof if there should be an occurrence of contentions.

Enhanced reports and bits of knowledge: Financial revealing, combined reports, and robotized bookkeeping support. Can quicken and streamline compromise of transactions.

This gives you charge, expense, transaction, and discount information continuously by means of Stripe’s API and Dashboard. When a transaction is settled.

- Note – Stripe is giving part and tied payment system that can assist you with paying A to B or either C in one payment portal.

These likewise speed up and rearrange how you get paid from bound together payouts.

Brace yourself for what I’m about to tell you –

How Much Does Stripe Cost?

- Stripe offers a basic and clear pricing plan. It has no setup or month to month charges. Rather, you possibly pay when you utilize the service.

- The pricing rate is just 2.9% + 30¢ per effective charge! For credit and credit cards.

- For the cost of other payment techniques, you may allude to the merchant’s evaluating list.

- It likewise offers an Enterprise bundle which includes some significant pitfalls quote premise. Contact the seller for subtleties.

For debate, questioned payments bring about an expense of $15. This charge is completely discounted if the client’s bank settles it to support you. You may think!

Financing time can shift contingent upon your MSP. The business normal subsidizing period is between 2-5 business days.

QuickTip: 3

Stripe is a cloud payment platform! That intended to enable you to acknowledge and oversee online transactions. It gives you a start to finish solution with highlights to process online payments. Making it perfect for web-based business or online organizations. At its center is a powerful payments motor that streamlines the development of money.

Stripe offers different items to address essential phases of your payment forms. The completely coordinated worldwide payments platform offers an across the board solution. To cover your payment of tolerating, preparing, settling and accommodating, and overseeing payments.

It likewise has to charge models intended for quickly developing organizations. This empowers you to charge clients with an irregular receipt! Or on the other hand on a naturally repeating premise.

Give me a chance to demonstrate to you the distinction in the middle of Authorized.net, Paypal and Stripe.

After this, the following payment entryway is –

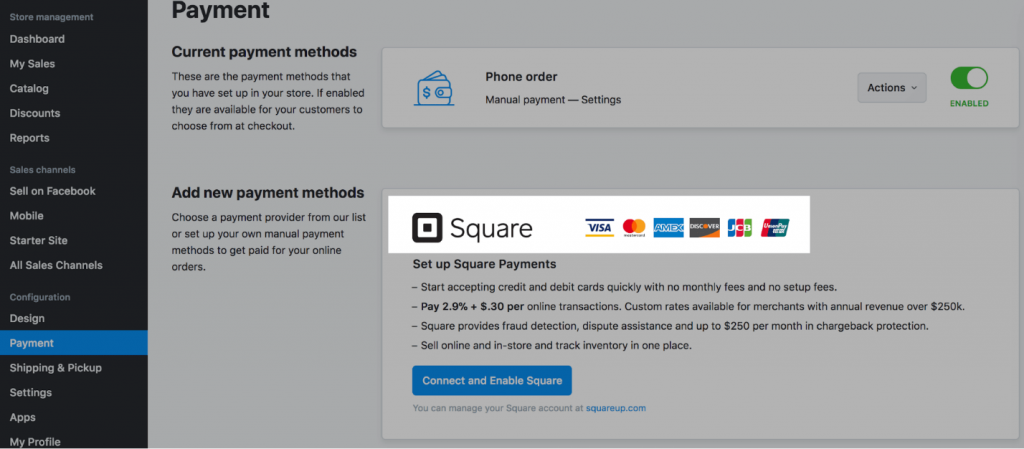

Square

- Year Founded – 2009

- Platform – Web | Android | iOS

- Nations Served – Australia, Canada, Japan, United States.

- Ventures – Restaurants, Hospital and Health Care, Retail, Marketing and Advertising, Design, Management Consulting, IT Services.

- Utilized by – Glaze, NOE Valley, ALTERNATIVE, Miette, norabloom, PALMER, HONEY BUTTER FRIED CHICKEN, YO! TACO!

Square is a mobile credit card processor for private companies. It has no month to month charges and a low-level transaction rate. Organizations searching for a Mobile credit card processor frequently swing to Square. With low costs, simple setup, and numerous highlights, it’s anything but difficult to perceive any reason why

Square was one of the primary mobile card perusers accessible. Today, it’s not only a payment processor – it’s additionally an incredible purpose of the offer.

Entrepreneurs can take! Visas, oversee stock, make solicitations, and oversee representatives with one program.

It takes under 10 minutes to agree to accept the service.

Subsequent to setting off to Square’s site, you download the application and are prepared to acknowledge credit cards in minutes. The Square card peruser is free and fittings directly into the client’s telephone or tablet.

Square doesn’t require an agreement and acknowledges all real Visas.

Presently an inquiry may strike a chord!

What is Unique About Square?

Simple Sign-up: You can join on the web or through the application. You’ll enter your name, address, date of birth, and Social Security number.

You’ll additionally require your financial balance number to gather the stores, however, you can enter that after the record is open. There’s no extensive application process or downtime hanging tight for endorsement.

Straightforward set-up: After setting up a record, you can tweak your dashboard setup. On the dashboard, you can enter various areas, modify receipts, make custom classes, Tax settings, and stock.

You can likewise set up a dedication program, deal with representatives’ hours and deals, and make custom reports.

No month to month expense: The Square is allowed to download and you can get the Square peruser at no charge. The main charges you pay are the per-transaction expenses as you make them. In case you have multi-month without any transactions, you don’t pay anything for the service.

Low costs: The fundamental Square card peruser is free if you arrange it on the web. In case you get it at a retail location, it costs $10.

For example;

In any case, Square repays the $10 to your assigned record after enactment. You can include different gadgets for discrete charges. We talk about them in the pricing area underneath.

Speedy stores: Square stores your assets inside two business days. To the assigned record in your dashboard. In case you need Instant Deposit, it will cost you 1% per store.

Moderate structure: Square’s dashboard has a smooth plan. What’s more, it functions admirably for novices and specialists alike.

It’s anything but difficult to modify the presentation and access the additional devices! With the intuitive interface.

Acknowledge disconnected payments: If you get thumped disconnected, you can at present acknowledge payments! Be that as it may, just swiped payments. Chip cards and contactless payments require the web. The system will store the data for 72 hours.

In the event that you don’t include web inside that time, the transaction terminates. Notwithstanding, you do assume full liability for terminated or declined cards.

Acknowledges gift vouchers: You can move and acknowledge gift vouchers in any category. The dashboard offers default measures of $10, $15, $20, $25, and $50 gift vouchers. You can tweak the sum by modifying these default esteems in the dashboard.

Permits the utilization of numerous gadgets on one record: Square enables you to have up to 75 areas! Under one ace record. On the dashboard, you can modify the points of interest of each branch! What’s more, even code the stores so you can tell which branch made the deals.

Offers numerous different services: Through the Square dashboard! you can oversee –

Stock, make loyalty programs, oversee finance, book appointments, and alter your online store.

- Note – In case you are searching for the affixed payment technique, Square payment entryway is for you.

Brace yourself for what I’m about to tell you –

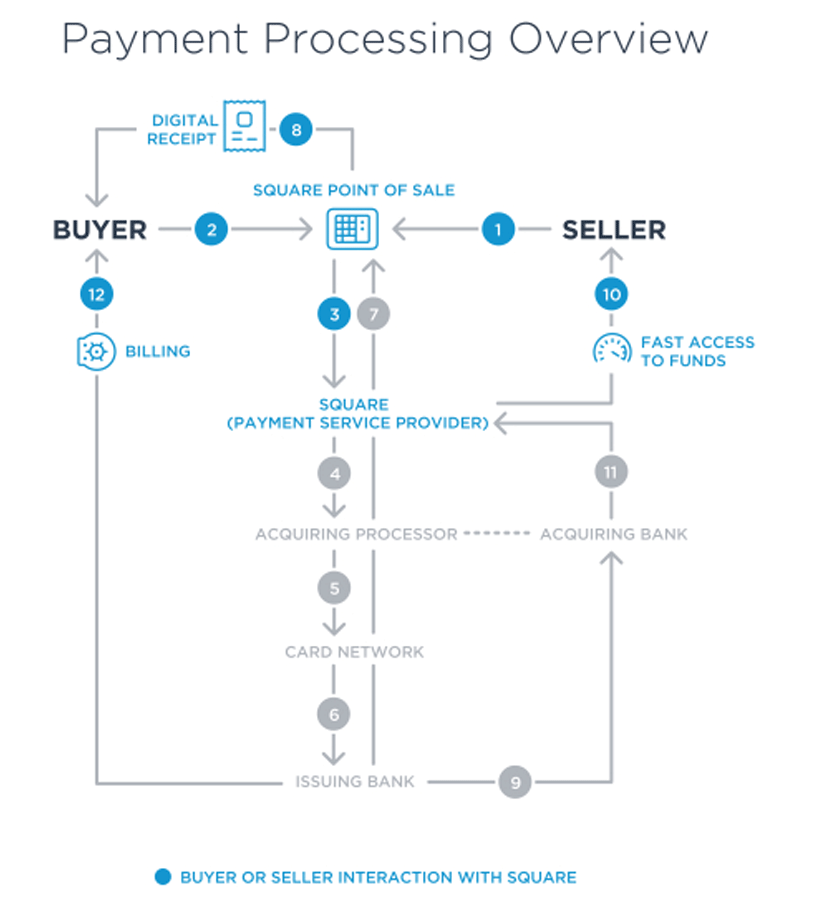

How Square Works?

When the Buyer is prepared to make a buy, the Seller inputs the transaction into the Square Point of-Sale (POS) and presents the Buyer with the sum owed.

The Buyer pays for the transaction by swiping or plunging their payment card, or by tapping their NFC-empowered cell phone on the Square Reader or Square Stand, which catches the Buyer’s record data.

The Square POS sends the payment transaction data to Square, which goes about as the Payment Service Provider (PSP).

Square passes the payment transaction data to the Acquiring Processor by means of a web association. Square pays a little-settled charge for each transaction to the Acquiring Process.

Presently, I will let you know –

The amount Does Square Cost?

I’ll be straightforward – I miss the times of having the capacity to state Square charges simply 2.75%. Since that is valid for a ton of traders, yet it’s not the entire story.

You may pay an alternate rate contingent upon which POS application you use, or in the event that you have Square Register or Square Terminal.

But, I’ll try to improve things as much as I can.

Look at the definite breakdown.

- Square Point of Sale (With Mobile Card Reader): 2.75% per swipe, plunged or tapped transaction

- On Register: 2.5% + $0.10 per swiped, plunged, or tapped transaction

- On Terminal: 2.6% + $0.10 per swipe, plunged, or tapped transaction

- For Retail POS: 2.5% + $0.10 per swipe, plunged or tapped transaction

- For Restaurants POS: 2.6% + $0.10 per swipe, plunged or tapped transaction

- Appointments (Individual User): 2.75% per swipe, plunged or tapped transaction

- Square Appointments (For Teams): 2.5% + $0.10 per swipe, plunged or tapped transaction

- Keyed-In and Card on File Transactions: 3.5% + $0.15

- eCommerce Transactions and Invoices: 2.9% + $0.30

Other Fees: None. This incorporates chargeback expenses. Square even offers a chargeback assurance program! It will take care of the expenses of qualified chargebacks, up to $250 every month, regardless of whether you don’t win the case.

The $0.10 per-transaction expense for Square –

- Register,

- Terminal,

- Retail

Eateries is a major change from the level rate it charges. In case you’re utilizing the Square Point of Sale application. The significant takeaway is that merchants with a normal ticket! Under $40-50 will end up paying more on that solution, so ensure the expense legitimizes the update.

Is it true that you are a Canadian dealer? Square backings –

Interac Flash charge for $0.10 per transaction

and credit transactions for 2.65% per swipe, plunge or tap.

Besides some slight pricing contrasts! Not every one of Square’s contributions might be accessible yet — for instance, Register, or the updated POS applications.

Subsidizing time can shift contingent upon your MSP. The business normal financing period is between 3-7 business days.

QuickTip: 4

Square by and large stores assets into traders’ ledgers inside 1-2 business days! Barring ends of the week and occasions. Notwithstanding, merchants who require their assets quicker! They can choose a moment or planned stores for 1% of the transaction sum.

Square has as of late extended outside the US! So it’s not even close as far-reaching as Stripe or Braintree. Right now, Square backings merchants in Canada, Japan, Australia, and the United Kingdom. Bolstered payment strategies and estimating fluctuate dependent on which nation you live in.

After this, let me present the following –

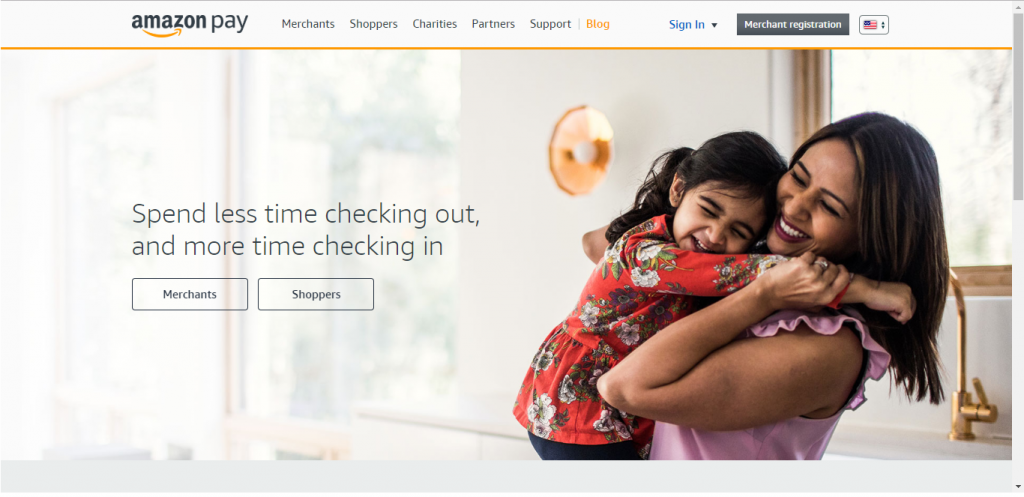

Amazon Payments

- Year Founded – 2007

- Platform – Android |iOS | Web

- Nations Served – United States, Germany, United Kingdom, Spain, France, Italy, Canada, Japan.

- Ventures – Retails, Apparel and Fashion, Consumer Goods, Wholesale, Health, Wellness and Fitness, Food and Beverages, Sporting Goods, Restaurants, Consumer Electronics, Luxury Goods and Jewelry.

- Utilized by – Eat This, Innovative Training Systems, UNTUCKit LLC, Blue Steele Inc, Suzy Cohen Healthy Lifestyle.

Amazon additionally offers a safe and streamlined payment benefit for its customers! Alongside notoriety like the one of PayPal Payments Pro. The service is accessible to the two merchants and customers! To encourage their online buys.

As it works with the data you’ve just embedded in your Amazon account. To finish registration and registration.

With a single login!

The client is quickly distinguished and empowered to finish a transaction. A plausibility that is likewise accessible on cell phones. Amazon’s beginning to end Guarantee makes these transactions 100% secure.

What’s more, charges no extra expenses to do as such. All things considered with most payment doors! Customers are just charged a settled level of the sum they are transferring.

Inside their Amazon Payments bundle, traders will likewise discover a completely included eCommerce suite. That will enable them to advance, move, and oversee items and requests. In such a way, Amazon Payments streamlines their commercial center exercises.

What’s more, changes over them into solid merchants with incredible notoriety. To enable reach to out to universal gatherings of people.

Amazon Payments works in a few distinct dialects and backings every driving money.

Give me a chance to disclose to you its uniqueness.

What is the uniqueness of Amazon Payments?

Streamlined obtaining process: It empowers clients to effortlessly get to their data from the merchant’s site. Along these lines streamlining the buying procedure.

As they never again need to enter their data, for example, Name, shipping address, and Visa subtleties among others.

Retail-first: Amazon Payments is planned explicitly for online retailers and vendors. Who needs to give a smooth shopping background to their purchasers.

The bundle is stacked with instruments and highlights. That is worked to draw in new clients and transform them into rehash customers.

They streamline their shopping procedure and enhance client dedication. Through adjustable repeating payments among others.

A-Z assurance and Protection plan: Amazon is known for actualizing exceptionally strict conventions. With regards to data security.

Its system gloats of vaunted security setup. That additionally incorporates misrepresentation recognition and merchant security.

Enhanced change rates: Amazon Payments enables traders to streamline their clients’ checkout encounter.

Because of which there is less truck deserting, and more guests wind up faithful customers. Shopping is disentangled both on nearby and cell phones. What’s more, makes it simple to simple to peruse through shopping locales.

Pick what you need, and pay without experiencing the problems of trucks and checkouts.

Transaction-based expenses: With Amazon Payments, there is no month to month memberships and licenses to stress over. All expenses are transaction based and have a preparing and approval part.

The transaction expense is made out of a residential preparing charge of 2.9%. What’s more, an approval expense of $0.30, in addition to imposing charged. At the point when the buy is effectively approved and prepared.

- Note – In case you are searching for coordinated payment strategy, Amazon pay is the best decision for you. Be that as it may, it’s not giving fastened payment technique.

Now, let me tell you, how Amazon Payment functions?

You might consider its price, Right?

The amount Does Amazon Payment Cost?

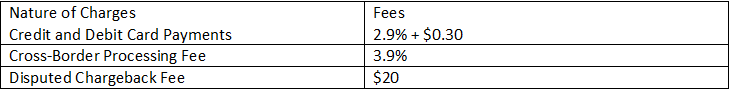

Amazon Pay charges the accompanying:

- Domestic Processing (2.9%),

- Cross-Border Processing (3.9%),

- Authorization ($0.30),

- Disputed Chargeback ($20).

Expenses are likewise charged where appropriate. Their cost as of now incorporates Amazon a to z Guarantee, extortion identification, and counteractive action innovation, and approval and confirmation of clients with commonplace and trusted login data.

When a discount happens! Residential and cross-fringe handling transaction charges are refundable. Not at all like the approval and debated chargeback expenses.

Subsidizing time can shift contingent upon your MSP. The business normal financing period is between 2-7 business days.

QuickTip: 5

Pay with Amazon, merchants will see their change rates enhance fundamentally as the checkout procedure turns out to be quicker. This streamlined checkout encounter results in less truck deserting and improved reliability from customers.

Presently, you know how you will be profited by Amazon Payment? After this, I will talk about the following one.

Skrill

- Year Founded – 2001

- Platform – Android | iOS | Web

- Nations Served – adsPlex, Artext, NKON, BigShareShop, DepositPhotos, DynaDot, DHgate.

- Businesses – Wholesale, Health, Retails, Apparel and Fashion, Consumer Goods, Wellness and Fitness, Food and Beverages, Sporting Goods, Luxury Goods, and Jewelry Restaurants, Consumer Electronics.

- Utilized by – United States, UAE, UK, India, Japan, Philippines, Serbia, Brazil, Australia, Germany.

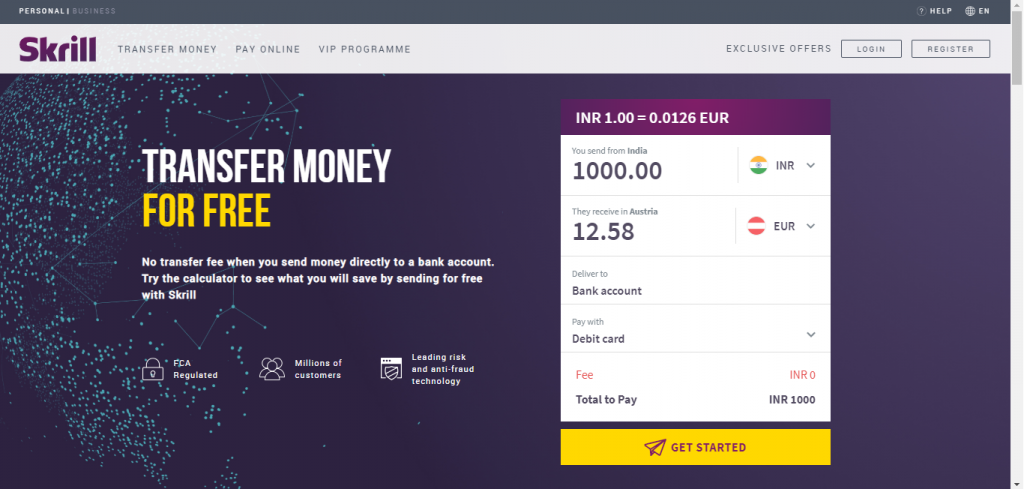

Skrill is a generally new! however, extremely fruitful UK-based payment benefit planned both for organizations and people.

Utilizing it, you can make worldwide transactions. What’s more, pay for items and services wherever you are on the planet.

And furthermore from the solace of your own one of a kind cell phone with a devoted application. Inside Europe, dynamic clients can likewise present a demand for a prepaid Master card. What’s more, use it to pull back assets/buy merchandise wherever they might be.

Making a record on Skrill is free! Furthermore, clients are just charged a settled level of what they’re sending/accepting.

On the sender’s side, this expense is as low as 1% of the transaction’s esteem. That makes Skrill an ideal alternative to a lot progressively costly platforms.

And furthermore the best entryways on the planet. Skrill is likewise simple to connect to any ledger around the world. What’s more, takes phenomenal consideration of the security of your payment data.

Presently, brace yourself for what I’m about to tell you –

How does it function?

After this, I will let you know –

Why Skrill is Best for Your Business?

Various transaction strategies: Skrill empowers a few payment transaction choices! For example, Mastercards, money, and email-transactions. You should simply join the web and benefit the services.

Focusing on purchasers around the world: Right now, Skrill bolsters more than 30 distinct monetary standards! What’s more, makes it conceivable to target purchasers for your items and services all around the world.

Extreme wellbeing and straightforwardness: With Skrill, you get definitive security. That securely transactions high-esteem money to your record. Your passwords and basic data is kept secret. To ensure there are no odds of any disasters.

With hostile to misrepresentation screening highlights. All the transaction to and from your record is checked. That guarantees high security.

Mobile records and ATM benefit: Your record chips away at mobiles gadgets as well. What’s more, it gives you a chance to make transactions and payments from anyplace.

An incredible probability empowered by this service is to get a MasterCard. Furthermore, pull back money from ATMs around the world.

POS Addition: Skrill is a significant convenient apparatus for POS organizations and online stores. You can pay for stuff online with your record. This is a most profitable expansion.

Since numerous clients forsake the buy though because of failure to pay in a flash. With Skrill being as simple as it seems to be, clients will make the most of their shopping knowledge.

- Note – in the event that you are searching for a part or fastened payment entryway, skill is there for you.

Try to keep your hat on –

The amount Does Skrill Cost?

In the event that the retailer acknowledges Skrill payments, the transaction will be free. Most different transactions, in any case, do accompany a charge! In spite of the fact that there’s no expense to get money. In rundown:

- 1% expense to stack assets into your record

- 1.45% transaction charge

- 3.99% money change charge

- up to 7.5% withdrawal charge (differs by payment strategy, with bank transactions being the slightest costly)

For instance: In case you’re transferring $1,000 from your Skrill record to a companion in the UK! Skrill will deduct a transaction charge of 1.45% ($14.50). Alongside a 3.99% ($39.90) money change charge. Your companion will get $936.60.

While you can utilize Skrill in Australia, every one of your transactions must be in USD. This implies you will cop the 3.99% money transformation charge before you send your money anyplace.

Financing time can fluctuate contingent upon your MSP. The business normal financing period is between 3-5 business days.

QuickTip: 6

Skrill can change over your money into 40 distinct monetary forms and offers a high most extreme transaction sum. With Skrill, you get definitive security that securely transactions high-esteem money to your record. Your passwords and basic data is kept the secret to ensure there are no odds of any disasters.

With against extortion screening highlights, every single transaction to and from your record is observed which guarantees high security.

After this, I will examine the following one –

2CheckOut

- Year Founded –

- Platform – Android| iOS | Web

- Nations Served – Asia, Canada, China, Europe, Latin America, United Kingdom, United States.

- Ventures – Internet, Hospital and Healthcare, Civic and Social Organization, Information Technology and Services, Nonprofit Organization Management, Arts and Crafts, Computer Software, Design, Education Management.

- Utilized by – 01Net, ABBYY, ABSOLUTE, AiseeSoft, Blogging Junction, CyberLink, HP, IRIS Canon.

It is another completely included payment preparing solution! That shows up on all comparable best records and groupings. Explanations behind that don’t need! It empowers dealers to acknowledge mobile and online payments from purchasers around the world.

Furthermore, with no worry in regards to deferrals and security. In case you wish to get paid in a flash, look no more distant than 2CheckOut.

- For the 16 years, it has been available!

- 2CheckOut served over 50k merchants

- Built more than 300 exceptional misrepresentation counteractive action rules

- Reached Level 1 PCI consistency.

- Supports 8 distinctive payment types

- 87 distinctive monetary forms,

- 15 dialects

- operates on in excess of 200 worldwide markets.

It’s a sandbox testing highlight! Doesn’t just guarantee that you will have the capacity to associate it with every single essential commercial center.

Yet additionally, you will get the chance to mark the payment portal in accordance with your business particulars. Furthermore, modify each and every detail of your checkout. To guarantee an increasingly customized understanding for clients.

Brace yourself for what I’m about to tell you –

Why 2CheckOut is Useful For Your Business?

Support for all driving payment techniques: 2Checkout is best known for supporting all driving payment strategies.

Among MasterCard, Visa, Discover, American Express, JCB, credit card, and PayPal.

Worldwide accessibility: 2Checkout enables you to work in 211 markets gives limited alternatives! Enabling dealers to tweak the platform.

As expected to move in the client’s dialect and money. And furthermore, give restricted payment alternatives that are offered in that showcase.

In the event that your business has repeating transactions! At that point, the platform offers repeating charging which guarantees smoother transactions.

2 checkout alternatives to browse: 2CheckOut improves clients’ purchasing knowledge with 2 distinctive checkout strategies.

- Standard – Shows the checkout page contingent upon the client’s gadget.

- Inline – Appears as though the Checkout page is a piece of the merchant’s site. While giving every one of the advantages of a facilitated checkout solution.

Likewise, you can make tweaked membership gets ready for its clients! In view of your eCommerce needs.

PCI Security norms: Any transaction entered in 2Checkout is destined to be secure much appreciated. To the platform’s Payment Card Industry (PCI) Data Security Standard. Its PCI security is Level 1 affirmed!

The most elevated confirmation conceivable that ensures all out assurance. For both merchant and client from conceivable extortion.

Coordination to 100+ shopping baskets and bookkeeping systems: Offers integration with in excess of 100 web-based shopping baskets and invoicing systems! That incorporates Shopify, Magento, and WP web-based business, among others.

A suite of open API is additionally accessible. It will empower your site to be coordinated with 2Checkout’s amazing payment platform.

- Note –In case you are searching for universal payment from India like coordinated payment system, 2checkout is the best one for you.

You may consider!

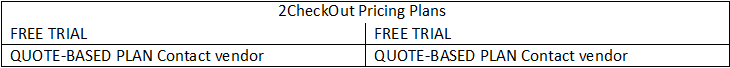

The amount Does 2Checkout Cost?

2Checkout offers two pricing rates dependent on fruitful transactions made. No month to month designs or setup expenses is charged.

- Simple Pricing – 2.9% + 30¢ per fruitful transaction (US rates; rates shift per nation)

- Volume Pricing – accessible by the statement, so contact the seller straightforwardly for more subtleties

Financing time can fluctuate contingent upon your MSP. The business normal financing period is between 3-9 business days.

QuickTip: 7

The platform underpins an assortment of transactions over numerous payment strategies. What’s more, it bolsters showcases over the whole globe. It gives benefits that are dependable and solid, as proof. By in excess of 50,000 merchants overall who have officially confided in 2Checkout.

The whole checkout encounter gave by 2Checkout! That is structured considering one objective to augment your transformations. By adjusting to neighborhood parts of your industry.

These perspectives incorporate components, for example, dialects, monetary forms, and payment techniques.

After this, let me move to the last one –

SagePay

- Year Founded – 2001

- Platform – Android | iOS | Web

- Nations Served – Australia, Canada, Japan, South Africa, United States, United Kingdom.

- Enterprises – Software Support, IT Services, Hospital and Healthcare, Civic and Social Organization, Information Technology and Services, Nonprofit Organization Management, Arts and Crafts, Computer Software, Design, Education Management.

- Utilized by – Europcar, Avoca, HFE, Lorna Syson, BBC Children in Need, Today Toyshop, Aspecto.

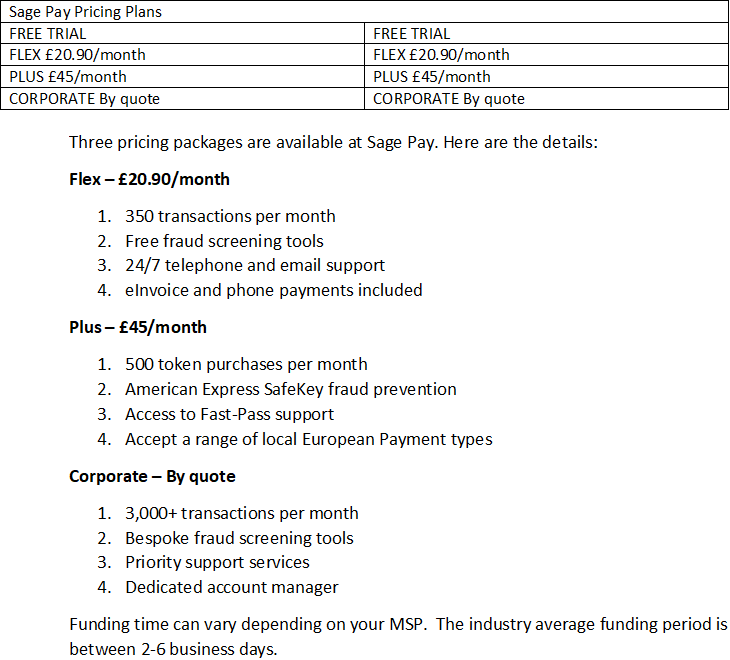

Sage Pay is made for organizations hoping to work with different payment techniques. What’s more, cover Mobile and online payment patterns.

Streamlining in such way the checkout experience of their end clients. To remain on the ball! Sage pay receives an exceptional eye to eye payment philosophy (mobile, remote, and contactless).

For online payment apparatuses, receipt payments, and telephone payments devices.

What makes Sage Pay a start to finish solution is that it acknowledges all payment types. Counting PayPal transactions in more than 25 unique monetary standards.

All payment pages can be custom-made and modified to meet marking determinations. Also, secured with cutting edge extortion anticipation components at no extra expenses.

Assets are typically transaction to ledgers inside 2 working day. Also, information is naturally put something aside for dispersion on your other Sage records.

The platform likewise offers a cloud revealing instrument (MySagePay). That causes you to get an unmistakable diagram of the present condition of every one of your payments.

Pondering extra highlights?

Try to keep your hat on –

Why Sage Pay is a Reliable Option for Your Business?

Praiseworthy notoriety: With a greater amount of 15 years of dynamic market support. The once little UK-based startup. What’s more, it became out to be one of the world’s most dependable payment and fund preparing specialist co-op.

Some portion of a huge and coordinated bookkeeping suite: If you’re as of now a Sage item client, Pay will be considerably progressively advantageous. The organization brings practical solutions that meet your business needs.

Alongside best class security, including Sage One, Sage 50, Sage 100ERP, Sage HRMS, and some more.

Card terminals: Sage Pay enables you to gather up close and personal payments through card terminals. That makes it a helpful instrument for stores and organizations that utilization POS systems. You get a very intelligent touchscreen system. Alongside clear and basic presentation making your activity simple as well as fun as well.

Online terminals for gathering telephone payments: Sage Pay offers additionally an electronic virtual terminal. What’s more, it enables you to gather payments via telephone. Handling mail orders wind up less demanding on the grounds that there is lesser or no printed material included.

Robotized invoicing: Automated instruments for receipt payments. Alongside extensive client bolster. That makes Sage Pay a lot more secure and best choice. For other payment preparing services in the district.

- Note – If you are searching for coordinated payment strategy without diverting to any outsider service, sage pay is there for you.

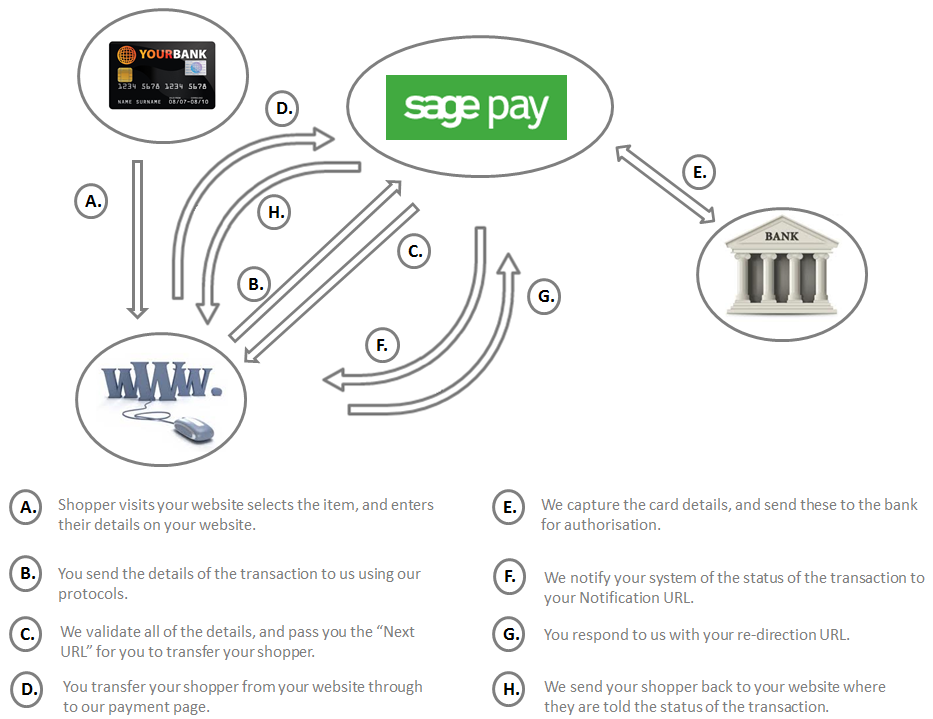

You will scarcely believe, How Sage Pay Works?

After this, I am going to tell you,

How Much Does SagePay Cost?

QuickTip: 8

Sage Pay has a great deal to offer for web-based business and other online organizations. Counting direct mix into best web based business platforms. For example, Shopify, WooCommerce, OpenCart, PrestaShop, and some more. At the point when joined with extortion counteractive action instruments, and independent venture contributions.

Like multi-channel following, so you can see a purchaser’s adventure over your channels. Also, Sage Pay is amazingly appealing to both new and built up e-rears.

Sage Pay coordinates with 36+ web-based business platforms. For example, Drupal, Big Commerce, Magento, EasyCart, Sage CRM, Salesforce, ZenCart and some more. The merchant account additionally incorporates with up to 3,500 programming and web-based business accomplices.

Conclusion

I hope you understand the science behind it. Here, I have discussed top 8 Payment Gateways in 2019 and the industries who use the most. I have specified each one in detail.

As a company (ChromeInfoTech), lots of customers are asking me, ‘Tell me which payment gateway is best for my mobile application? Which is best in price and quality of services?

Lots of questions are coming to us related to payment gateways! So, I thought, instead of telling every single person, I can write a blog which should have all the information that people needs to know. I have answered all the questions in this post. I wish your all the doubts and issues will be resolved by reading the above post.

If you need professional assistance or integration of payment gateway in your mobile app, you can reach us at ChromeInfoTech. We are a well-known Software Development Company and we provide ideal services that can transform your idea into a huge success.

Our certified developers are well experienced and highly dedicated to providing you success mobile application as per your need and expectation.

We say, ‘Ideas are responsible for the progression and prosperity of humans – without them, we would still be living in prehistoric times. No idea is too small, and all sorts of ideas have the potential to change the world as we know it for the better’.

Just come up with your idea and you will see how we polish your idea to turn into a profitable and successful app. Just read the blog post and share your reviews in the comment section. It will be appreciated and valuable for us. If I have left anything so do let us know your recommendation or suggestion in the comment!

Thank you!

+1 (512) 3331-934

+1 (512) 3331-934 +44 (161) 8188-928

+44 (161) 8188-928